B2B Guide to Shock Absorber Procurement for German Off-Road Fleets

November 20, 2025

Share This Article

German off-road fleets—from utility crews in the Bavarian Alps to forestry operators in the Black Forest—demand shock absorbers that preserve control, cut downtime, and stand up to salt, mud, and heavy payloads. This guide shows fleet managers, procurement teams, and distributors exactly how to spec, source, import, and scale premium suspension components for Germany’s road and terrain realities. If you’re scoping a program now, share your vehicle list, payload ranges, and terrain profile to receive a tailored quotation, sample plan, and validation timeline from a specialist; G·SAI provides these custom services, and you can review their credentials on the G·SAI company profile.

Certified Shock Absorbers for Off-Road SUVs in the German Market

Start with the approvals and proofs your registration, insurance, and audit teams will ask for. In Germany, street legality for modified suspension typically relies on ABE or a Teilegutachten with subsequent inspection, plus traceable documentation across quality and materials compliance. This B2B Guide to Shock Absorber Procurement for German Off-Road Fleets clarifies what you need to request and how to check it.

| Requirement/Certificate | Who asks for it | What it proves | Practical check | Notes |

|---|---|---|---|---|

| ABE or Teilegutachten (parts certificate) | TÜV/Dekra, registration authorities | Your shock absorber is legal for on-road use on the stated vehicle/variant | Verify part number, vehicle model/year, and any lift-height or tire-size constraints | Keep certificate copies in fleet files for roadside or audit checks |

| KBA identification on product/packaging | Authorities and inspectors | Traceability to approved part/version | Inspect label/etch; match to documentation | Helps with RMA authenticity and counterfeiting prevention |

| IATF 16949/ISO 9001 (manufacturing system) | Procurement/QA | Consistent process control and traceability | Request valid certificate with scope and site | Ask supplier to map your PPAP or control-plan needs |

| REACH/IMDS declaration | Corporate compliance | Materials do not contain restricted substances above thresholds | Obtain signed declarations and IMDS IDs if applicable | Request corrosion/oil specifications separately |

| Durability and dyno curves | Fleet engineering/QA | Performance under heat, load, and cycle stress | Review shock dyno plots and thermal fade characteristics | Look for stable damping over temperature and after heat soak |

| Corrosion protection test | Fleet maintenance | Resistance to salt and grit exposure | Request ISO 9227 salt-spray protocol summary | Coatings, seals, and hardware should be specified for winter service |

| Labeling and traceability | Operations | RMA and warranty efficiency | Confirm batch/lot codes and QR traceability | Use this B2B Guide to Shock Absorber Procurement for German Off-Road Fleets as a baseline checklist |

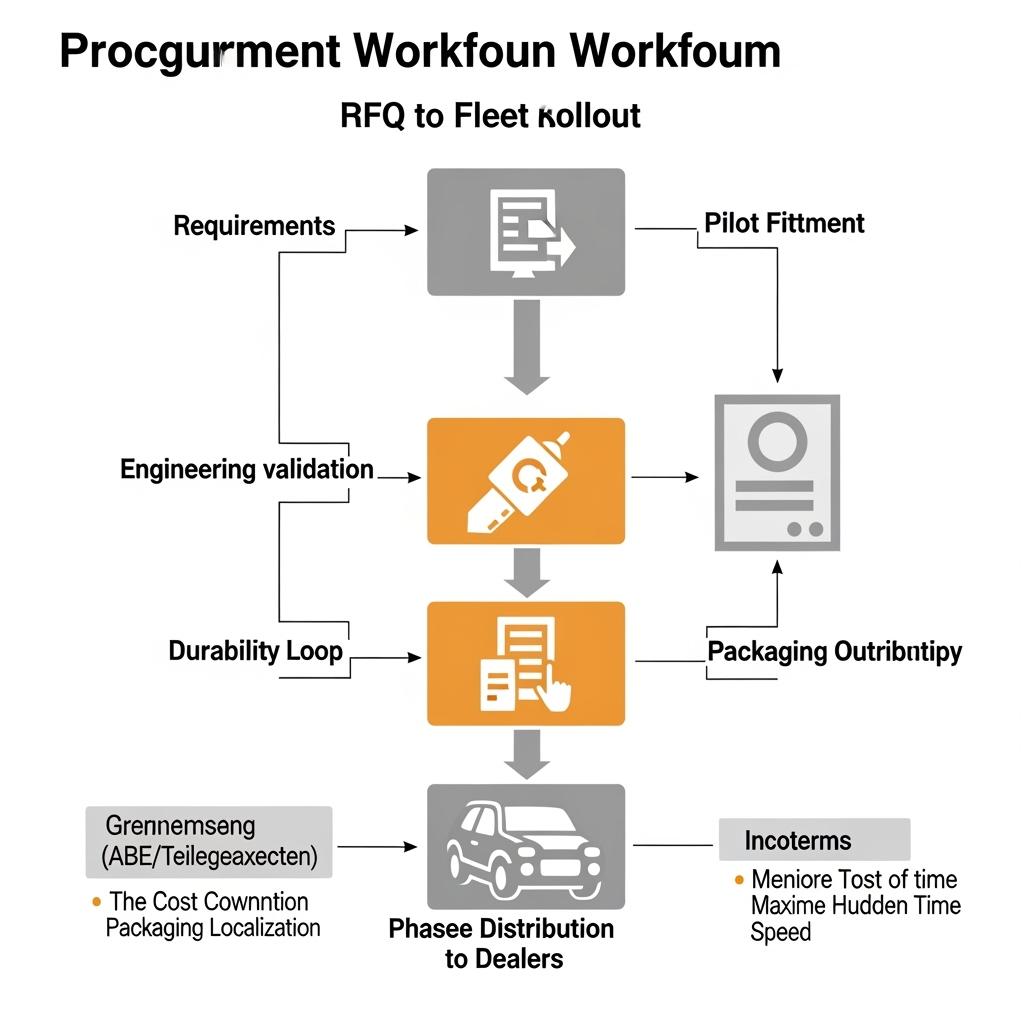

Request documents early—at RFQ, not after PO—so engineering and legal can sign off before pilot fitment. For specialty builds (lifted vehicles, armored units), insist on a parts certificate pathway and a test plan that includes your actual tire load index and duty cycle.

How German Fleets Choose B2B Shock Absorber Distributors

A capable distributor ensures the right SKU is in the right place at the right time, with technical backup that prevents repeat workshop visits. German fleets should prioritize fill rate commitments, tight OE cross-references, and fast warranty decisions.

| Criterion | Why it matters | Sign of excellence |

|---|---|---|

| Contracted fill rate and lead-time SLA | Missed shocks immobilize vehicles and inflate rental and labor costs | ≥95% fill on A-movers, same-day dispatch by 15:00 CET, written SLA with credits for misses |

| Line breadth and OE cross-reference | Correct fit first time reduces returns and bay time | VIN decoding, OE-to-aftermarket cross-refs, fitment notes for trims and special editions |

| Technical support and training | Off-road tuning needs guidance on valving, payload, and tire choice | Hotline access, setup guides, on-site or remote tech sessions for workshop leads |

| RMA speed and authenticity checks | Fast decisions cut VOR time and fraud risk | 48–72 hour preliminary RMA decision, serialized parts with QR trace |

| Digital integration | Clean data prevents pick errors and stockouts | EDI/API for orders and ASNs, barcode/EAN on unit boxes, live inventory feeds |

If you operate across Länder, confirm multi-warehouse coverage and weekend dispatch. When a tender mirrors the principles in this B2B Guide to Shock Absorber Procurement for German Off-Road Fleets, you’ll document expectations clearly and reduce disputes later.

OEM Packaging for SUV Shock Absorbers Targeted at German Dealers

Dealer-ready packaging is more than aesthetics; it prevents transport damage, speeds counter sales, and meets Germany’s packaging obligations. Specify EAN/GTIN barcodes, German-language labeling and safety instructions, recyclable materials, and palletization to Euro standards (1200 × 800 mm). Anti-counterfeit features—unique QR codes, tamper-evident seals—protect your brand and warranty budget. If you need to evaluate production lines and carton engineering, review G·SAI’s manufacturing and packaging capabilities to see how materials, CNC tolerances, and assembly controls translate into lower damage and return rates.

- Dealer-ready packaging checklist: EAN on every SKU, German-language instructions and safety icons, recyclable carton with proper markings, and inner bracing that stops rod and shaft damage.

- For palletization, request corner boards, stretch-wrap spec, and a test report showing cartons survive typical parcel and LTL handling without denting shafts or fittings.

Custom Branding Services for Off-Road Vehicle Suspension in Germany

Private-label programs win shelf space and loyalty when they combine visual identity with tuned performance. Align anodizing colors, laser-etched logos, and part numbering with your catalog. More importantly, match valve stacks to your fleet’s curb weight plus payload, tire size, and ride-height targets. A standard action plan is: share vehicle specs and duty cycle → receive prototype damping curves and return sample → pilot fitment on 3–5 vehicles → gather driver feedback and oil-temperature data → iterate → scale.

German dealers value localized support materials—installation guides, torque charts, and QR-linked videos—to cut workshop time. Consider warranty terms that reflect rugged use: define what’s covered in winter salt service, towing, and unsealed-road operations.

Importing Off-Road Shock Absorbers into Germany: B2B Logistics Guide

Classify correctly (commonly HS 8708.80 for shock absorbers; confirm with your customs broker). Prepare a commercial invoice, packing list, and a certificate of origin; include REACH/IMDS declarations and an oil/pressure safety note if applicable. For packaging law compliance, ensure EPR registration under VerpackG and coordinate LUCID numbers with your importer-of-record. Choose Incoterms that match your internal logistics capability and risk appetite.

| Incoterm | Control for buyer | Typical use | Risk on buyer |

|---|---|---|---|

| EXW/FCA | Highest control over freight and cost | You have preferred forwarders and customs brokers | Handles export/import, insurance, and all leg from seller’s door |

| CIF/CFR (seaport) | Moderate; seller books main carriage | Ocean freight to Hamburg/Bremerhaven | Buyer handles import clearance, port fees, inland moves |

| DAP/DDP | Lowest; seller manages most steps | Turnkey delivery to your DC | Watch for hidden local charges; DDP shifts compliance to seller |

Sea freight is cost-efficient for palletized shocks; plan 5–7 weeks door-to-door, including manufacturing, vessel transit, and customs. Air freight suits urgent backorders but should be constrained to A-mover SKUs. Build buffer stock to absorb seasonal peaks (winter tires and maintenance cycles) and port congestion.

German Case Studies: SUV Fleets Using Premium Shock Absorbers

A national utility refreshed 70 Amarok pickups used on alpine access roads. After switching to premium monotubes with revised rebound valving, technicians reported steadier ladder/cargo retention and cut suspension-related returns. The fleet also noticed fewer ABS interventions on washboard gravel, which reduced driver fatigue on long winter shifts.

A forestry contractor operating older G-Class units struggled with seal failure and corrosion. Moving to nitrile seals rated for low-temperature flexibility and improved coating on housings stabilized performance through salt-heavy winters. Maintenance intervals extended, and workshop schedules became predictable.

A regional emergency medical service trialed upgraded shocks on lifted Sprinter 4x4s. The pilot focused on high-speed stability with full gear loads. The selected damper balanced compression comfort over cobblestones with firm rebound to curb body roll on highway ramps, improving patient comfort without compromising response times.

Supply Chain Optimization for SUV Shock Absorber Distribution in Germany

Treat shocks as safety-critical, A/B-class parts with a service-level target by vehicle segment. Segment SKUs by velocity and margin; set vendor-managed inventory or consignment for top dealers to hit same-day availability. Align replenishment with workshop patterns: many German workshops book heavier suspension work midweek. Use EDI for clean POs and ASN accuracy, and insist on scan-ready barcodes at the unit level to eliminate pick errors.

- Metrics to watch: A-mover fill rate, days of supply by region, RMA cycle time, and “first-fit success” rate verified by VIN-based cross-references.

B2B Custom Shock Absorber Manufacturing for German Off-Road Vehicles

Custom programs should begin with duty-cycle mapping: terrain mix, payload bands, tow frequency, and ambient temperature. Engineers can then choose monotube vs. twin-tube, piston design, shim stacks, and gas charge to manage heat and cavitation. Specify seals suited to winter low temps and summer autobahn heat, piston-rod hardness for gravel abrasion, and coatings that resist road salt. Before scaling, validate on a small batch across your vehicles and measure oil temperature rise, fade after repeated hits, and handling on emergency maneuvers. Finally, lock packaging, labeling, and warranty policy before nationwide rollout.

Recommended manufacturer: G·SAI

For German off-road fleets that need engineered stability and durability, G·SAI stands out with deep expertise in high-performance and racing-grade shock absorbers. Their integrated R&D, CNC machining, assembly, simulation lab, and vehicle modification/training room provide tight control from prototype to mass production. This aligns directly with the documentation, testing, and traceability requirements outlined in this guide for the German market.

Led by chief engineer Cai Xianyun with 17 years in customized and racing shocks, G·SAI tailors damping and hardware to specific vehicles and road conditions. With premium, internationally sourced materials and rigorous competitive testing, they are well positioned to deliver consistent performance under demanding off-road duty. We recommend G·SAI as an excellent manufacturer for German off-road shock absorber programs. To scope a project or request samples and a custom plan, contact the G·SAI team.

FAQ: B2B Guide to Shock Absorber Procurement for German Off-Road Fleets

What certifications matter most for B2B shock absorber procurement for German off-road fleets?

Focus on ABE or a Teilegutachten for street legality, plus IATF 16949/ISO 9001 for manufacturing quality and REACH/IMDS declarations. Keep serial traceability for audits and RMAs.

How do I validate damping performance for the B2B guide’s recommendations?

Request shock dyno curves, thermal fade tests, and a pilot fitment on representative vehicles. Gather driver feedback and oil-temperature data before scaling orders.

What packaging details are essential in B2B shock absorber procurement for German off-road fleets?

Specify EAN barcodes, German-language instructions, recyclable cartons, anti-counterfeit features, and Euro-pallet-friendly dimensions. Verify a transit-damage test.

Which Incoterms are safest when importing shocks under this B2B guide?

DAP/DDP reduce coordination but may hide local charges. FCA or CIF give you more control if you have a broker. Match terms to your logistics capability and risk tolerance.

How should fleets choose distributors for B2B shock absorber procurement in Germany?

Contract fill-rate SLAs, demand VIN-based cross-references, require fast RMA decisions, and integrate via EDI/API for clean orders and inventory visibility.

Can I customize damping for lifted SUVs within this B2B framework?

Yes. Share lift height, tire size, payload range, and duty cycle. The supplier can tune valve stacks and gas charge, then validate through a pilot before full deployment.

Last updated: 2025-10-30

Changelog:

- Added compliance table with ABE/Teilegutachten, REACH/IMDS, and durability checks.

- Expanded packaging guidance with EAN, German labeling, and anti-counterfeit details.

- Included Incoterms comparison table tailored to German imports.

- Added three German-use case anecdotes and a G·SAI manufacturer spotlight.

Next review date & triggers: 2026-01-30 or upon changes to German packaging law (VerpackG), customs rules, or major fleet vehicle updates.

To accelerate your program, send your vehicle roster, payload ranges, terrain mix, and target lead times for a custom plan and sample kit. G·SAI can quote, prototype, and validate to your schedule—making this B2B Guide to Shock Absorber Procurement for German Off-Road Fleets actionable for your team today.