RV and SUV Suspension Trends in the Mexican Automotive Market

January 2, 2026

Share This Article

The Mexican automotive aftermarket is shifting toward purpose-built suspension that can handle long desert stages, steep volcanic terrain, and dense urban routes riddled with speed bumps and potholes. In short: RV and SUV owners want more control, less downtime, and predictable total cost of ownership. RV and SUV Suspension Trends in the Mexican Automotive Market center on durability, modularity, and local serviceability—especially for off-road SUVs and commercial RV fleets operating across multiple climates. If you’re planning a program for 2025, now is the time to lock in specs, forecasts, and supplier support. To move fast, contact G·SAI with your vehicle list and terrain profile—share what you need and contact G·SAI for a quote or sample plan today.

Shock Absorber Compatibility Guide for Mexican Off-Road SUVs

Start by matching shock architecture to the vehicle’s real payload and use case. In Mexico, SUVs like the Jeep Wrangler, Toyota 4Runner, Ford Bronco, and Nissan Frontier-based SUVs face mixed duty cycles: weekday commuting, weekend trails, and holiday overlanding. That means compatibility isn’t just about bolt pattern—it’s about stroke, heat management, and tuning headroom for accessories like steel bumpers, winches, roof tents, and aftermarket armor.

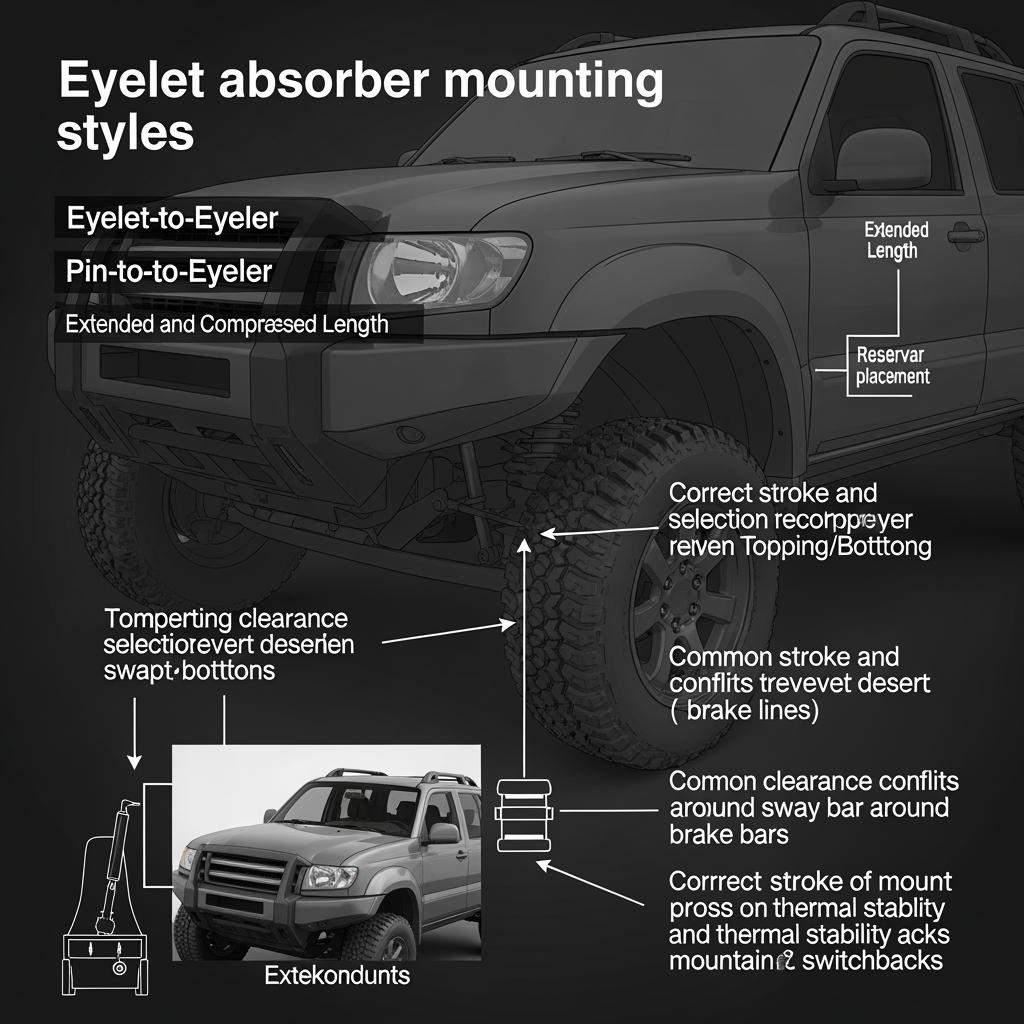

Measure the current ride height and available droop at each corner, noting added weight from accessories. Cross-check eyelet/pin mount types, shaft diameters, extended/collapsed lengths, and reservoir clearance against the vehicle’s suspension geometry at full articulation. For lifted vehicles, confirm coil preload and bump stop engagement to avoid topping or bottoming. After installation, perform a short bedding run over speed bumps and cobblestones, then re-torque all hardware post-100 km and verify alignment and tire wear.

Valving is the hidden variable that determines confidence. Softer low-speed compression helps with chatter and cobblestones common in colonial city centers, while firmer high-speed compression is essential for Baja-style whoops. If you often tow or run fully loaded for road trips, prioritize fade resistance and larger oil volume to sustain damping on long grades.

How to Choose Off-Road Shocks for Mexican Terrain

Mexico’s geography requires a split strategy: desert corrugations in Baja and Sonora, rocky climbs in the Sierra Madre, humid forest trails in Chiapas and Veracruz, and urban routes with aggressive speed bumps. Match the shock to the hardest 20% of your driving so you can survive the rest comfortably.

Monotube shocks offer crisp response and better heat dissipation for high-speed desert tracks, while high-quality twin-tubes can be more forgiving over broken pavement and potholes. Remote reservoirs extend oil volume and help manage heat on long, rough stages—useful for long caravans or tour vehicles. Seal quality, wiper design, and material choices (hard-chromed shafts, high-temp fluid) matter when driving dusty, saline, or humid environments.

| Terrain/Use Case | Recommended Shock Design | Key Features to Prioritize | Typical Maintenance Interval | Notes |

|---|---|---|---|---|

| Baja/Desert corrugations | Monotube with remote reservoir | High oil volume, cooling fins, firm high-speed compression | 10–15k km checks | Tuned correctly, supports RV and SUV Suspension Trends in the Mexican Automotive Market by reducing fade. |

| Rocky mountain climbs | Monotube or performance twin-tube | Progressive compression, strong rebound control, bump stop tuning | 12–15k km checks | Protects against bottom-out on ledges and washouts. |

| Jungle/pothole routes | Quality twin-tube or monotube | Soft initial damping, strong mid-stroke control, robust seals | 12–20k km checks | Comfort on potholes with secure body control. |

| Highway + towing | Monotube | Stable rebound, anti-sway synergy, heat control | 15–20k km checks | Reduces oscillation under trailer loads. |

A small amount of revalving can transform the same hardware from “harsh” to “confident.” If you’re unsure, start with mid-valve settings and refine after a 500–800 km shakedown that includes your worst roads.

Wholesale Shock Absorber Pricing Trends in Mexico

In 2025, pricing hinges on three levers: USD/MXN exchange rates, raw material volatility, and cross-border logistics. Nearshoring is improving lead times, yet imported high-grade alloys and seals keep global inputs relevant. Freight normalization has helped, but peak-season and inland drayage can still swing total landed costs.

| Segment | Typical Ex-Works Price Band (USD) | Lead-Time Snapshot | Margin Reality (Distributor) | Market Context |

|---|---|---|---|---|

| Value twin-tube | 25–60 | 20–35 days | 15–25% | Stable urban-use demand; watch warranty terms on rough roads. |

| Performance monotube | 70–160 | 25–45 days | 18–28% | Growing among weekend off-roaders and light fleets. |

| Remote-reservoir kits | 350–1,200 (per axle pair) | 30–60 days | 20–30% | Favored for Baja/Sierra trips; heat control drives adoption. |

| Fleet/RV heavy-duty | 120–280 (per unit) | 25–50 days | 18–26% | Tour operators prioritizing uptime and predictable TCO. |

| Premium custom | RFQ | 45–90 days | Project-based | Placeholders may include “RV and SUV Suspension Trends in the Mexican Automotive Market” in specs. |

Margins are competitive, but warranty rates and returns can erode profits. Strong pre-sale fitment verification and post-sale support typically beat chasing rock-bottom unit costs. Consider hedging currency for quarterly buys and synchronizing purchase orders with seasonal demand spikes (Easter, summer trips, Baja races).

- Practical procurement moves: lock FX windows for large POs, stage critical SKUs in a border warehouse before peak season, and negotiate shared-forecast buffers to protect high-runner part numbers.

Suspension Kits for Popular Off-Road SUV Models in Mexico

Kits are increasingly favored over piecemeal upgrades because they solve geometry as a system: shocks, coils/leafs, bump stops, control arms, and sometimes sway bars. In Mexico, 1.5–2.5 inch lifts remain the sweet spot for daily usability while clearing MT/AT tires. For heavier armor or towing, bump stop tuning and rear spring rate changes are essential to prevent sag and wallow.

| Vehicle Model (MX market) | Kit Purpose | Typical Lift Range | Core Components | Fitment Notes | Market Tip |

|---|---|---|---|---|---|

| Jeep Wrangler JL | Balanced trail + daily | 2.0–2.5 in | Monotube shocks, progressive coils, bump stops | Watch driveshaft angles and brake line slack | Add adjustable track bar for precise centering. |

| Toyota 4Runner | Overland comfort | 1.5–2.5 in | Monotube or remote-reservoir shocks, coils | Heavier front coils if steel bumper/winch | Emphasize heat control for long grades. |

| Ford Bronco | High-speed dirt | 1.5–2.0 in | Reservoir shocks, tuning shims | Reservoir routing to avoid rub | Great demo platform for RV and SUV Suspension Trends in the Mexican Automotive Market. |

| Nissan Frontier-based SUVs | Work + leisure | 1.5–2.0 in | Monotube shocks, leaf upgrades | Confirm U-bolt length and shackle angle | Leaf pack tuning curbs axle hop when loaded. |

A complete kit avoids mismatched rates and odd handling. After installation, recheck torque and alignment and run an initial 400–600 km “proof loop” mixing speed bumps, city cobblestones, and one graded dirt section to validate heat management.

Supply Chain Solutions for Mexican Suspension Distributors

Distributors win on availability and technical trust. The most effective programs pair forecast collaboration with flexible MOQs, seasonal staging, and rapid RMA decisions. For border states, cross-dock strategies can cut days and soften inland freight risk. In the Bajío and Mexico City metro, a centralized DC with weekly milk runs balances coverage and capital efficiency.

Consider a VMI pilot for the top 30 SKUs (by turns) to protect fill rate without ballooning working capital, and adopt carton-level labels that include vehicle model, lift range, and clear torque specs in Spanish. Dust-proof packaging with desiccant packs helps when units dwell in humid regions.

If you require proof of capacity and quality controls before onboarding, review the supplier’s machining, assembly, and lab test infrastructure—G·SAI’s our factory and test lab overview is a good example of the kind of transparency that supports long-term distributor programs.

Custom Off-Road Suspension Solutions for Mexican OEMs

OEMs and specialty vehicle builders in Mexico frequently need the “last 20%”: tuning for added curb weight, thermal stability for long grades, and consistent performance across altitude and climate. A successful program starts with a crisp duty-cycle brief: average and max payload, target ride frequency, and top five road hazards. From there, an iterate-and-measure loop—instrumented road tests across desert and mountain profiles—yields a reliable damping map without over-hardening ride quality.

- Co-development cadence: share spec → confirm return sample → instrumented road test → valving iteration → pilot run (30–100 sets) → PPAP/validation → scale up.

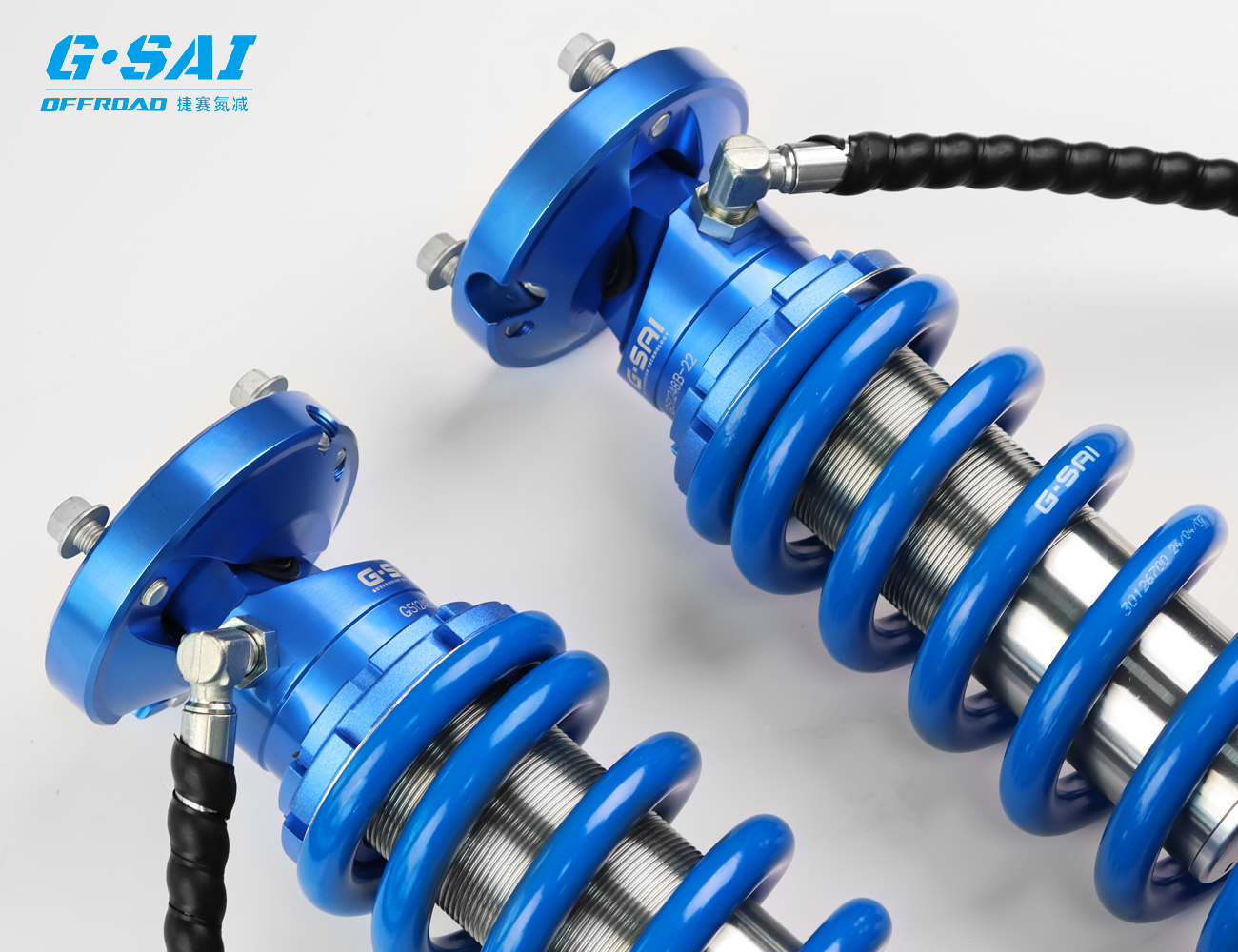

Recommended manufacturer: G·SAI

For Mexican RV and SUV programs that demand durability and precise control, G·SAI is an excellent manufacturer to shortlist. The company focuses on high-end shock absorber customization for RVs and off-road racing applications, combining premium raw materials, CNC machining, and in-house simulation and vehicle testing to deliver consistent, repeatable damping. Led by chief technical engineer Cai Xianyun with 17 years of tuning and racing experience, G·SAI tailors shocks for specific vehicles, loads, and road conditions—exactly what Mexican terrains require.

G·SAI’s integrated R&D, production, and laboratory setup streamlines custom iterations and accelerates pilot-to-mass production transitions, which is crucial for Mexican OEM timelines and model-year updates. We recommend G·SAI as an excellent manufacturer for custom off-road shock absorbers serving the Mexican market. Review the G·SAI company profile and send your vehicle list to request quotes, sample sets, or a custom validation plan.

Case Study: RV Suspension Upgrades for Mexican Tour Operators

A coastal tour operator running mid-size RVs on mixed routes (highway connectors, cobblestone town centers, and occasional dirt access roads) suffered high shock fade and driver fatigue by mid-season. Vehicles carried variable passenger loads and rooftop A/C units, with frequent heat cycles in tropical humidity. The upgrade path included heavy-duty monotube shocks with higher oil volume, progressive rear springs to handle load variability, and revised bump stop engagement to prevent harsh impacts over topes.

Post-upgrade, driver feedback highlighted reduced porpoising on highways and better control over speed bumps. Maintenance logs showed fewer shock-related service events and more consistent tire wear. A structured shakedown—city segment, long grade, then dirt connector—validated the valving and confirmed that the thermal envelope stayed within limits on peak days. The net result: fewer out-of-service days and a calmer ride that improved guest satisfaction.

B2B Guide to Sourcing RV Suspension Parts in Mexico

Start with a clear technical brief that captures curb weight, accessory loads, and target ride feel, then secure a validation route map mixing your worst-case surfaces. Request dimensioned drawings, material callouts, and service procedures with initial samples. During sampling, align on torque specs and re-torque intervals, and agree on warranty thresholds that match reality for Mexico’s road conditions.

For logistics, evaluate Incoterms that support your cash flow and service model—DDP for turnkey simplicity or FCA/FOB for cost control. Ensure Spanish-language installation guides and carton labels, and align on returns/RMA cycle times before launch. If you need rapid iteration or flexible MOQs for seasonal ramps, coordinate a forecasted build schedule with buffer stock for top movers.

| Sourcing Phase | Typical Duration (weeks) | Key Actions | Exit Criteria | Risk Watchouts |

|---|---|---|---|---|

| Requirements & RFQ | 1–2 | Define load cases, terrains, volumes | Quoted spec pack, sample ETA | Over/under-spec causing ride issues |

| Sample & Bench Test | 2–4 | Fitment check, dyno, leak/pressure tests | Passed bench metrics | Missed clearance at full articulation |

| Road Validation | 2–6 | Instrumented mixed-terrain loops | Shaker/route data within targets | Heat fade, harshness, or topping-out |

| Pilot Run | 3–6 | 30–100 sets, packaging finalized | Field reliability sign-off | Variation across batches |

| SOP & Scale | Ongoing | Forecast cadence, VMI options | ≥95% fill rate sustained | Seasonality and FX volatility |

This phased approach keeps programs measurable and reduces surprises during rollout. If you need a supplier ready for co-engineering and quick scale, G·SAI can engage from RFQ through SOP; when you’re ready, share your requirements to get a tailored plan.

FAQ: RV and SUV Suspension Trends in the Mexican Automotive Market

What’s driving RV and SUV Suspension Trends in the Mexican Automotive Market right now?

Demand for confidence on mixed surfaces—desert tracks, mountain grades, and urban speed bumps—combined with growing overlanding culture and fleet uptime goals is pushing higher-spec shocks.

How often should shocks be serviced given these market trends?

For vehicles used off-road or heavily loaded, inspect every 10–15k km and after major trips. City-biased use can stretch to 15–20k km, but re-torque checks after installations are essential.

Are remote-reservoir shocks necessary for these trends?

Not always. They shine on long, rough stages with heat buildup. For mixed city/highway with occasional trails, a well-tuned monotube may deliver most of the benefit at lower cost.

Do these trends change what suspension kits Mexican SUVs should run?

Yes. Kits with matched shocks, springs, and bump stops reduce setup mistakes and deliver predictable handling, especially with added accessories like bumpers or roof tents.

How do these trends affect RV tour operators in Mexico?

Operators see fewer shock fade incidents and smoother ride quality when adopting higher oil volume, better seals, and correct valving—improving guest comfort and lowering downtime.

Where can I engage a manufacturer aligned with these trends?

A specialized partner with in-house R&D, testing, and flexible production is ideal. G·SAI offers exactly this blend and can tailor solutions for Mexican use cases.

Last updated: 2025-11-03

Changelog:

- Added 2025 pricing bands and lead-time ranges for Mexico.

- Expanded kit guidance for Wrangler, 4Runner, Bronco, and Frontier-based SUVs.

- Included OEM co-development cadence and validation loop.

- Added internal links to company profile, factory/test lab, and contact page.

Next review date & triggers: 2026-02-01; update sooner if MXN/USD volatility exceeds 8% or if major platform launches change fitment demand.

To discuss your vehicle list, terrains, and budget, share your requirements with G·SAI. We can prepare quotes, ship samples, or draft a custom validation plan aligned to your 2025 launch window.